The foot or more of sea level rise government scientists recently predicted coastal cities and towns will see by 2050 doesn’t sound like much, especially if you live in a community that isn’t being impacted by the first foot of sea level rise that’s accumulated in the last hundred years. To people who own real estate located in areas that are now experiencing sea level rise flooding and those in the red zone targeted by the next foot, it’s a huge deal. I live in South Florida, and I’m witnessing firsthand what sea level rise flooding can do to a coastal community.

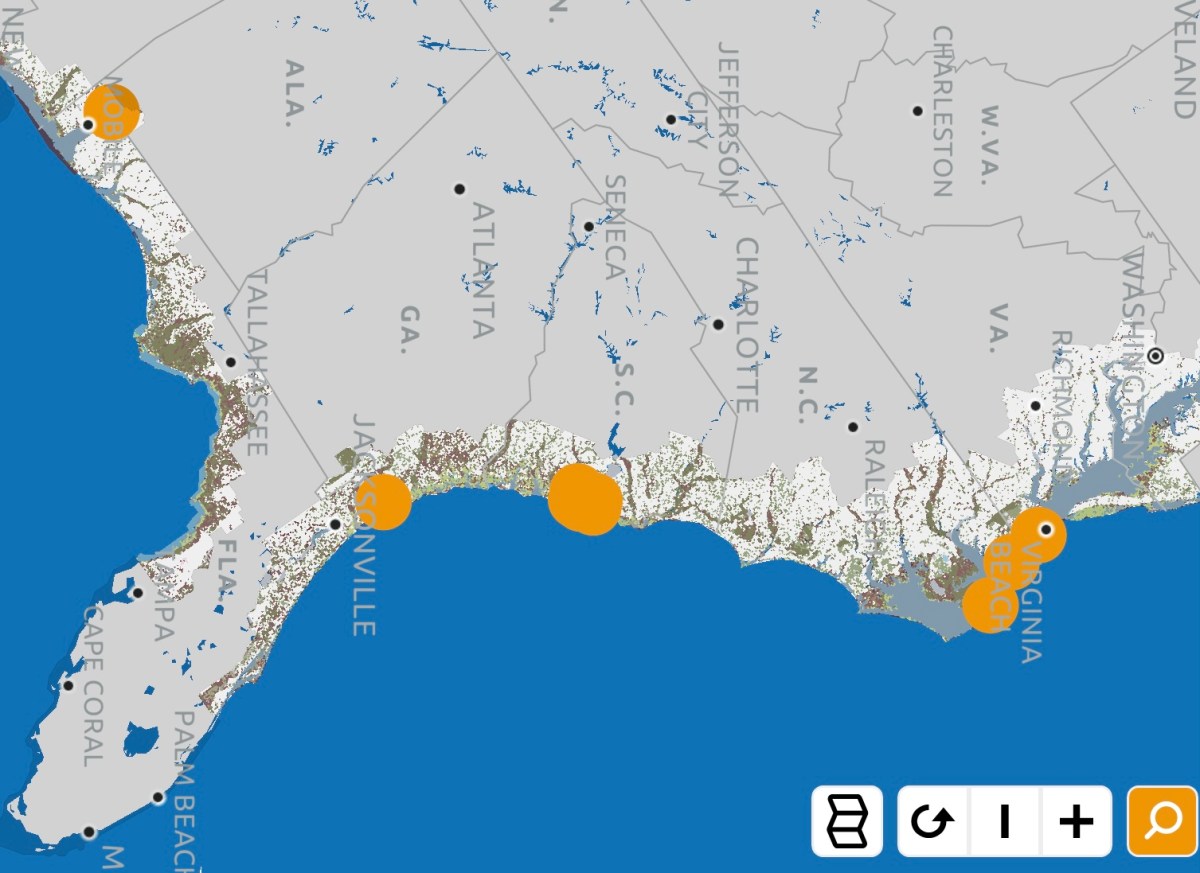

The Union of Concerned scientists predicted that an additional foot of sea level rise will put 140,000 homes at risk of flooding every other week. This means coastal cities and towns are going to have to step up their efforts to fend off floodwaters by, among other things, building higher seawalls, installing pump systems, elevating roads and other critical infrastructure, expanding flood-water absorbing wetlands, and replenishing eroded beaches.

Private real estate owners, too, are going to have to be more diligent in taking steps to protect their properties. More and more of them are going to have to install, reinforce or heighten seawalls and elevate docks, structures and entire homes. In condo communities, owners face the specter of higher association fees and special assessments to cover the cost of protecting common areas and buildings from flooding.

In cases where sea level rise floodwaters cannot be held back, private property owners are going to face a host of problems. As owners of real estate located in neighborhoods that flood now can attest, typically the first sign of sea level rise is seawater collecting on roadways or rising up out of storm drains that would normally drain into the ocean, a harbor or other waterway. Sounds like a minor problem, until you have to park blocks away from your home and wade through the water to reach your front door. Driving through seawater is out of the question. The salt is extremely corrosive to vehicles.

The next step in the typical sea level rise flooding progression is floodwater collecting on a property, where it can rend septic systems inoperable, pollute freshwater wells, and damage landscaping and exterior structures. In cases where the seawater enters a home, the costs can be devastating. FEMA’s National Flood Insurance Program website has a flood damage calculator that estimates an inch of water alone can cause nearly $27,000 damage to a 2,500 home. A foot of floodwater can cost over $72,000 to repair.

In extreme cases, local governments are determining that it’s no longer cost-effective to maintain and rebuild roads and critical infrastructure to serve properties that are repeatedly inundated. Officials are insisting on buyouts, where they pay an owner fair market value to abandon their homes. It’s important to note that buyouts are expensive and only possible where federal and state funding is available. It’s uncertain how long the government will be able to afford buyouts. If the funding dries up, real estate owners could be left with properties that regularly flood, aren’t insurable, and are impossible to sell.

The immediate coastline isn’t the only place at risk from sea level rise. In areas like South Florida that are built on porous limestone or Honolulu that are built on porous volcanic rock, higher seas can push seawater inland underground. The dense seawater, in turn, can force the fresh water table upward toward the surface where it saturates soils. This can create three problems: 1) Unable to absorb rainwater, the saturated soils can cause surface flooding; 2) Septic systems that rely on dry soil to filter impurities can become inoperable when saturated soils can’t handle any more water; and 3) Fresh water well systems can become polluted by saltwater making them unusable.

Beyond the physical problems floodwater presents to coastal communities, private property owners also have to keep an eye on trends in the property tax, insurance and mortgage sectors. Coastal communities are fighting for federal and state funding to pay for sea level rise control projects. When the money runs short, local taxpayers will have to cover the bill for flood prevention projects.

The National Flood Insurance Program is already in the process of making sure that owners of properties most at-risk of flooding pay higher premiums. And, after the tragic condo building collapse last summer in Surfside, Florida, mortgage backers Fannie May and Freddie Mac are now forcing condo associations to answer detailed questions about building maintenance and the level of reserve funds available to cover routine maintenance and repairs. In instances where buildings are deemed to be poorly maintained, short on cash, or unsafe, lenders will be barred from issuing mortgages. This new policy is already wreaking havoc in the South Florida condo market, where closings are being delayed due to the stringent requirements. The threat is compounded by the fact that even cash buyers can be forced to show that they will be able to get a mortgage if they don’t have enough resources to cover the cost of a condo.

With all of these factors in play, it’s clear that the prospect of another foot of sea level rise is something that real estate owners and buyers can no longer afford to shrug off and ignore. Every additional inch of water that accumulates between now and 2050 is going to compound the challenges faced by coastal communities. Due diligence — staying up to date on the latest developments and responding appropriately — is the only way to protect real estate investments.

You must be logged in to post a comment.